Letters of Good Standing

Return of Earnings Submissions for Rand Mutual Assurance

Letter of Good Standing

A Letter of Good Standing is granted by the compensation commissioner to state that a business is fully compliant and has met with the requirements of the COIDA.

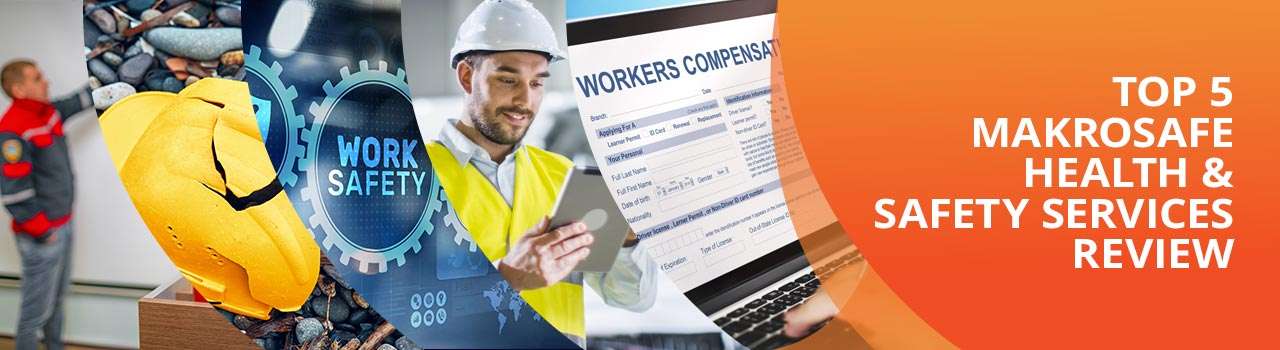

Top 5 MAKROSAFE Health and Safety Services Review

Businesses of all sizes and types must place a high priority on Occupational Health and Safety.

South African Employers can Help Industry to Return to Normal by being Pro Active in Health and Safety

South African Employers can Help Industry to Return to Normal by being Pro Active in Health and Safety - Blog

.jpg)